After one of the worst starts to a year for fixed income, returns may not get much better from here. Long-term interest rates have traded sideways recently but we expect rates to potentially rise further, which would put downward pressure on bond prices. We’re not giving up on high-quality fixed income though, as Treasury securities have shown to be the best diversifier during times of equity market stresses.

The Case for (still) Higher Treasury Yields

Interest rates have moved off their very low levels to start the year, but we think they can go higher. Higher inflation expectations, less involvement in the bond market by the Federal Reserve (more on this below), and a record amount of Treasury issuance this year are all reasons why we believe interest rates can move higher. We think the 10-year Treasury yield could end the year between 1.75% and 2.0%.

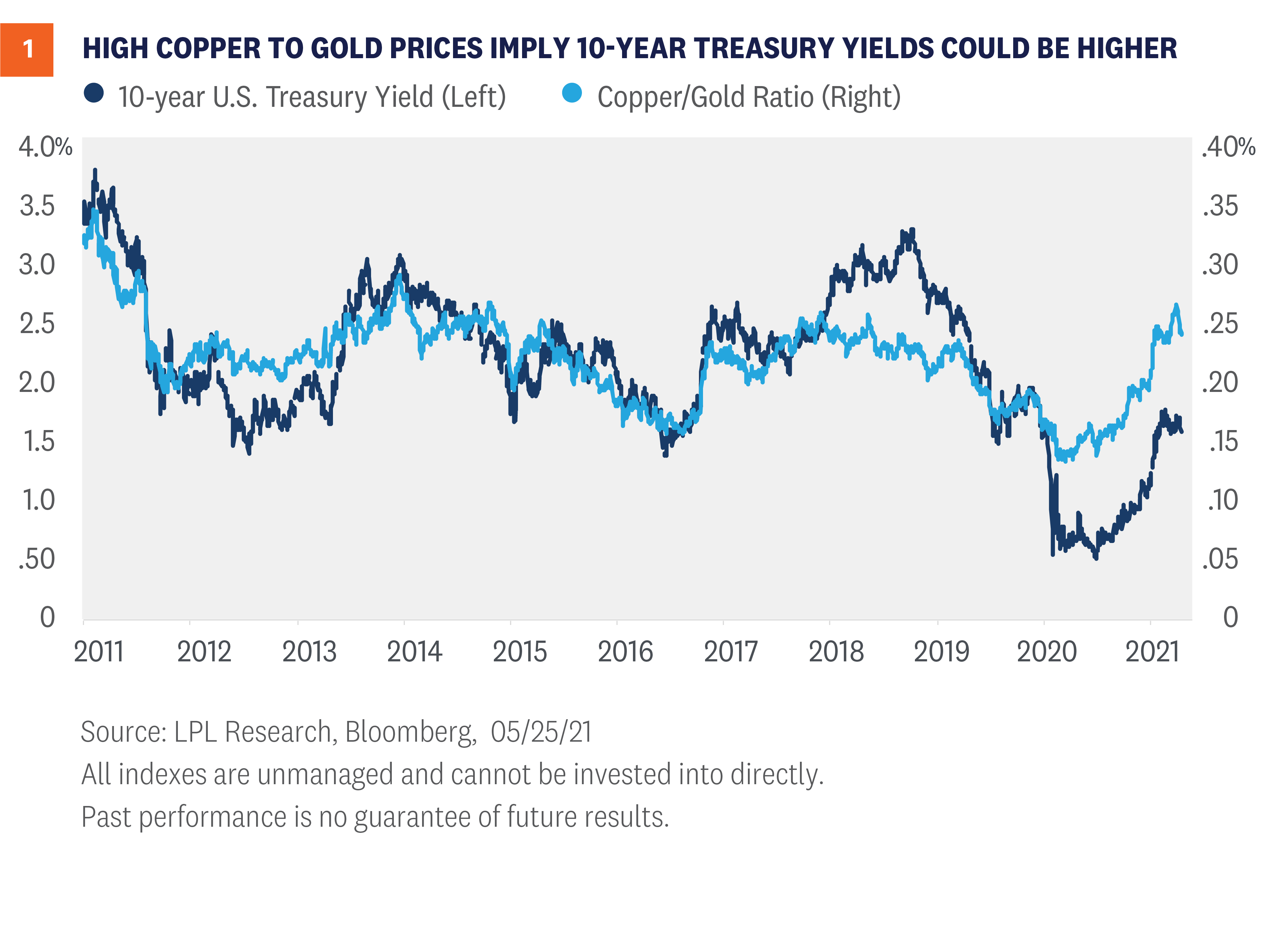

Inflationary pressures are building as the economy continues to recover. As one of bondholders’ main nemeses, inflation, erodes the “real” value of principal and interest payments, making them worth less. While we don’t believe inflation will be a lasting problem, we do expect higher consumer prices in the near term, which should nudge interest rates higher over the rest of this year. Moreover—and why we believe copper is an important commodity to watch, as seen in [Figure 1]—the ratio of copper prices to gold prices has been an important predictor of where the yield of the 10-year Treasury should be. Copper is an important input price for a number of products so, while copper prices have increased due to the strengthening of the global economy, 10-year Treasury yields haven’t kept up. While not a perfect predictor, the copper/gold ratio has been a fairly reliable one—and one that suggests interest rates can move higher than current levels.

Stalling Out

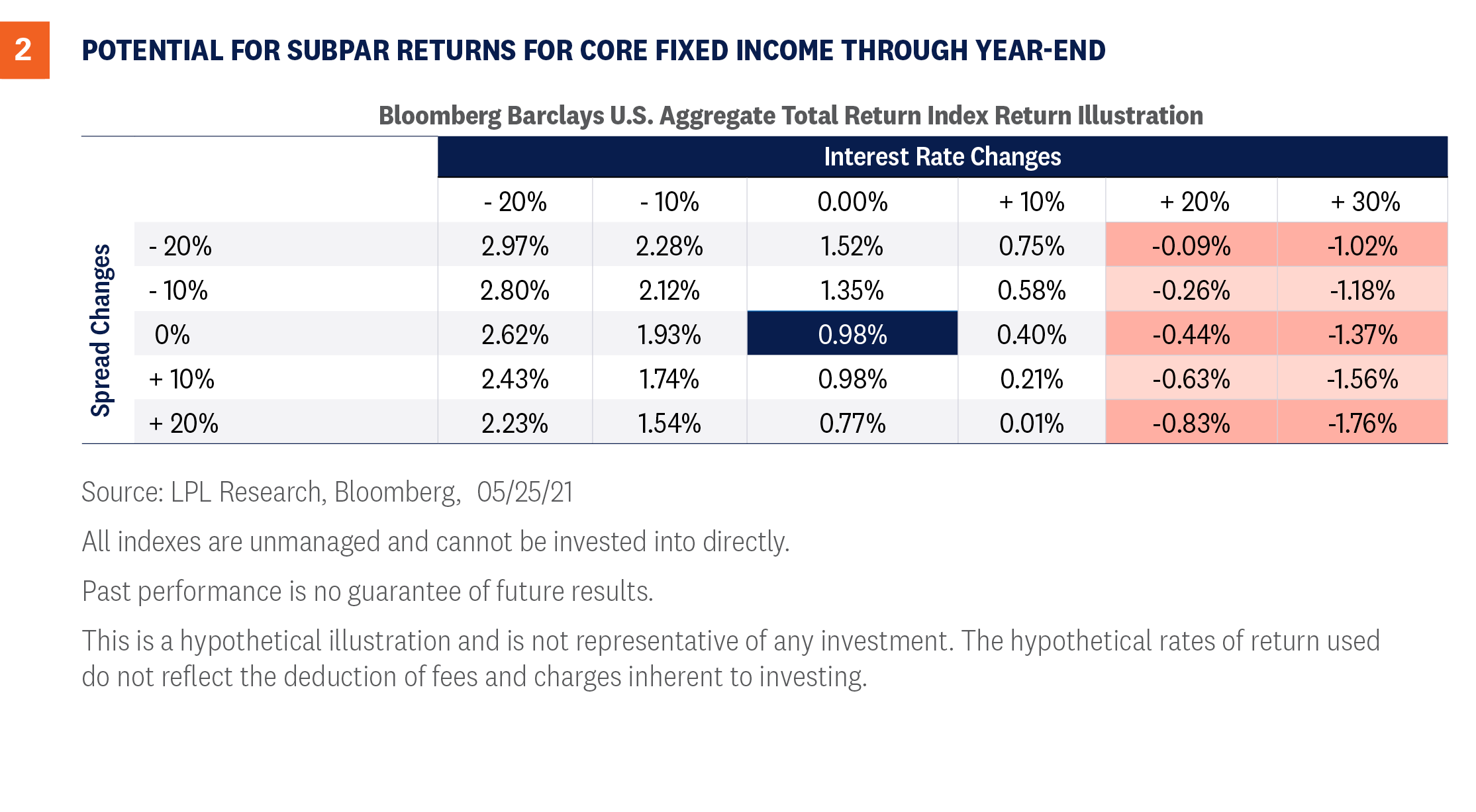

Rising Treasury yields have been a headwind to core fixed income returns this year. Generally speaking, the yield spread between Treasury securities and non-Treasury bond securities can help cushion losses when interest rates move higher (and bond prices fall). However, with valuations within most fixed income sectors already at lofty levels, there hasn’t been enough spread to offset rising Treasury yields. This has caused the prices of many bond sectors to fall as interest rates have moved higher. Unfortunately, we expect the trend of higher interest rates to continue, albeit at a much slower pace than what we’ve already experienced so far this year, putting further downward pressure on core fixed income returns. As seen in [Figure 2], expected returns for core fixed income (as defined by the Bloomberg Barclays U.S. Aggregate Bond Index) through the remainder of the year are low to even negative in certain scenarios. Because we believe interest rates will move higher from current levels, core fixed income returns may add more negative returns to the already negative year-to-date returns. If core fixed income returns are negative for the year, it will be the first time since 2013, which was the last time the Federal Reserve (Fed) started talking about tapering its bond buying programs. History may be rhyming again.

Portfolio Protection During Market Sell-Offs

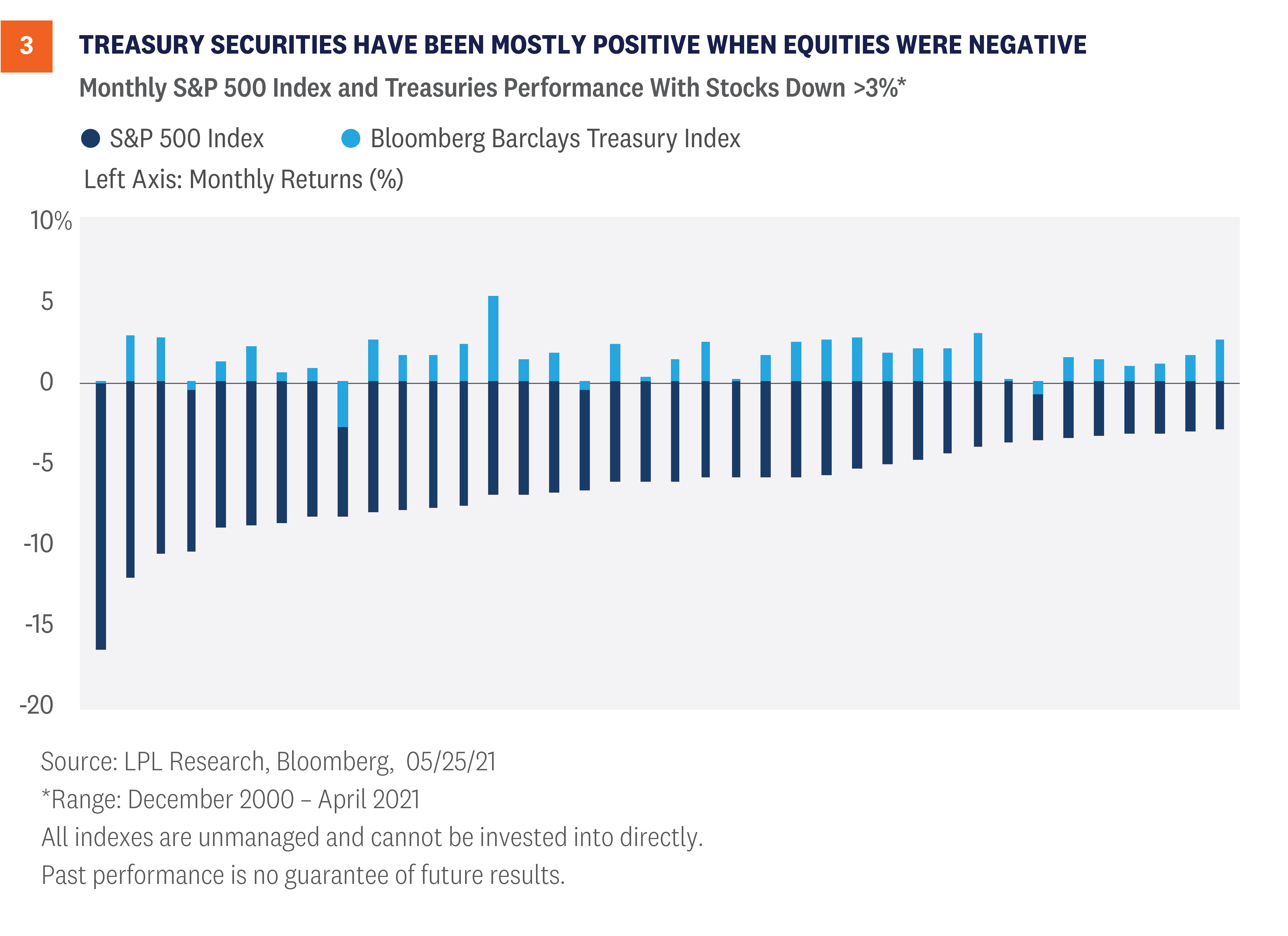

So, if we’re expecting higher Treasury yields and low-to-negative returns for core fixed income, why would anyone want to own bonds? Frankly, in case something bad happens to cause equity markets to sell off. Core bonds, and more specifically Treasury securities, have shown to be the best diversifier to equity market declines. [Figure 3] shows the monthly returns of the Treasury index during months when the S&P 500 Index was down 3% or more during the month. When we look at how Treasury securities have performed during periods of equity market selloffs, we can see that Treasury security returns have been mostly positive. When you consider stocks are in the second year of a bull market which, historically, has brought increased volatility, core fixed income can help dampen and potentially offset some of those losses. While we still like equities over bonds over the course of the year, we do think high-quality fixed income continues to serve a purpose in portfolios.

All Eyes on the Federal Reserve

When we evaluate the economic and financial landscapes, the Fed is a key risk we’re keeping our eyes on. Since March 2020, the Fed has supported the economy and financial markets by purchasing $120 billion in Treasury and mortgage securities, and by keeping short-term interest rates near zero. As the economy continues to recover, however, the need for continued monetary support wanes. While we still think it’s too early for the Fed to begin to increase short-term interest rates, we do think the discussion around reducing the size and scope of bond purchases will start to take place soon. How the market will react to these discussions is unclear at this point, and the policy risk associated with a possible communication error by the Fed is a risk that could cause interest rates to move higher.

Conclusion

Core fixed income returns have—not unexpectedly—been negative so far this year. With long-term interest rates near historical lows coming into the year and the economy on the mend, we thought interest rates would move higher this year—and they have. We think long-term interest rates still have room to move higher even after the big move this year, so bonds may experience subpar returns throughout the rest of the year. We still think high-quality bonds play a pivotal role in portfolios as a diversifier to equity risk. While we expect further gains for stocks through year-end, unforeseen events happen. And it’s best to have that potential portfolio protection in place before it’s needed.

Click here to download a PDF of this report.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

Please read the full Outlook 2021: Powering Forward publication for additional description and disclosure.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

RES-771250-0521 | For Public Use | Tracking # 1-05148588 (Exp. 06/22)